vermont income tax forms

The 2022 state personal income tax brackets. Send this form and your Advance Directive to the Vermont Advance Directive Registry to store it electronically so hospitals or other providers.

Vermont Labor Department Recalls 1099 Tax Forms Here S What To Do

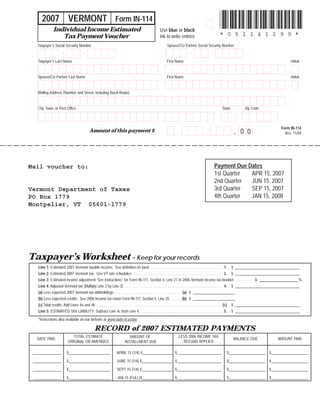

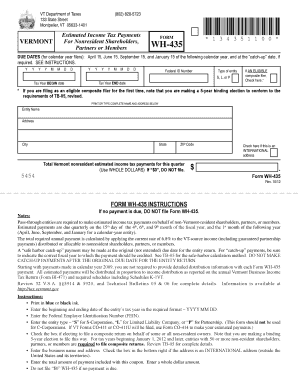

Estimated tax payments must be sent to the.

. TaxFormFinder provides printable PDF. Vermont has a state income tax that ranges between 3350 and 8750. The Taxpayer Advocate Service is an independent organization within the IRS and is your voice at the IRS.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Our job is to ensure that every taxpayer is treated fairly and. Click here to view Free tax.

Schedule your appointment ahead of time. Click here to view Reminders Resources. The state income tax table can be found inside the Vermont Form IN-111.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Prepare for Your Appointment. Bring the following items with you.

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations. The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875. Vermont State Income Tax Forms for Tax Year 2021 Jan.

Click here to view HS-122 HI-144 forms. Form IN-114 - Estimated Income Tax. Click here to view file income tax for free.

A current government-issued photo ID. Details on how to only prepare and. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes.

Online Tax Help IRS Free File. If you need hard copies of forms or booklets please use one of the contact methods below. IRS Free File allows you to prepare and file your federal individual income tax return for free using online tax preparation and filing software or Free File Fillable.

Advance Directive Forms. VERMONT INCOME TAX FORMS. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

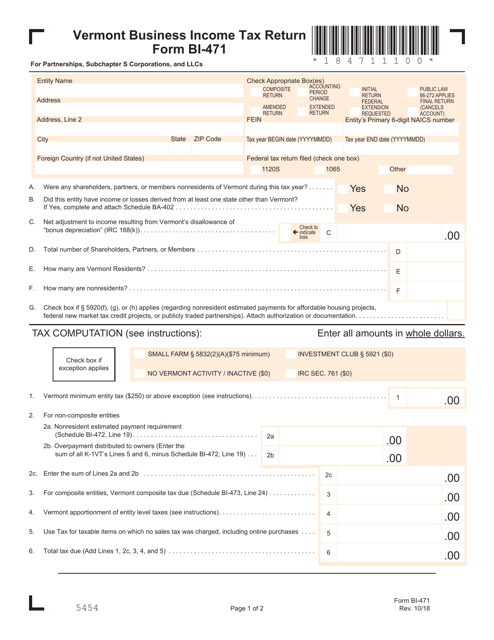

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller

In 151 Extension Of Time To File Vt Individual Income Tax Return

In 151 Extension Of Time To File Vt Individual Income Tax Return

Vermont Sales Tax Small Business Guide Truic

State Withholding Form H R Block

Form In 111 Vermont Income Tax Return

Vermont Income Tax Vt State Tax Calculator Community Tax

![]()

Vermont Llc How To Start An Llc In Vermont Truic

Arvin A Brown Good Ideas From Vt Public Libraries

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Free Vermont Power Of Attorney Forms 9 Types Pdf Word Eforms

Tax Forms Fairlee Public Library

The Complete J1 Student Guide To Tax In The Us

Vt State Tax Form Information Town Of Cave

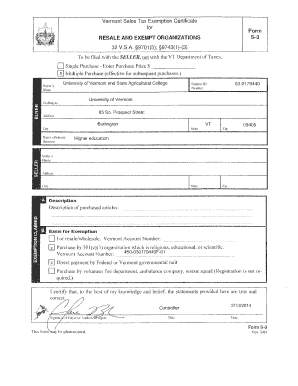

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Vermont Department Of Taxes 133 State Stmontpelier Vt 05633 1401united States Of America Fill Online Printable Fillable Blank Pdffiller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes